INTRODUCTION

With the blockchain innovation that is one of the greatest developments that have given us mechanical advances and the Internet, digital forms of money have started to enter our lives. In this article I will endeavor to present the Distributed Credit Chain venture.

Dispersed Credit Chain conveys credit to the blockchain and reestablishes ownership of data to individuals. It expects to make a progression of suburbanized money related administrations practically identical to Loan Registration, customer Loans and Blockchain Mastercards. By facultative quarterly chain innovation and restoring the benefits of learning to people, the Distributed Credit Chain mission is to differ the contrary spending situation and avow the imperative complete.

A virtual bank, by recommends that of shoddy cash related organization, can vision to disentangle syndication from a day by day spending establishment and re-take from budgetary organization to all or any providers and customers associated in such organization with the point that any benefactor UN office has added to the advancement of the system work might be made strides

The entire embodiment of the task is to make a pristine framework that looks to bring into the planet of monetary transfer, spotless and clear connection between the beneficiary and in this way the supplier. Consequently, the DCC means to unfalteringly adjustment the total existing imposing business model structure of the typical market of monetary foundations, all together that inside the future each member amid this division will procure their legitimate monetary benefit inside the system of the natural development of the framework.

THE PROBLEM DCC IS AIMING TO SOLVE:

1. CENTRALIZATION: This is one of the genuine test in the conventional budgetary foundation. It is alluded to as the circumstance where a specific framework is in absolute control. A procedure where profits, data and clients information are not relatively dispersed.

2. EFFECTIVENESS: There use to be not kidding delay in checking the borrower’s credit who don’t meet their hazard’s criteria which prompts misuse of assets and decline in proficiency.

3. COST: Additional cost is brought about on the borrower’s from the charges on their default expense. This adds to their loan fee, making it troublesome for them to make discounts.

4. PROFITEERING: This needs to do with the pointless premium created from the borrower’s winning by the budgetary foundation.

5. BORROWER’S INTEREST: In the vast majority of this conventional money related organizations, there is no framework that ensures the privileges of the borrowers. Therefore, their credit limits relies upon the material arranged for them. This really makes them to be not able know their right, in this manner ruining them from gathering their credit office.

This arrangement proffered by Distributed Credit Chain will generally turn the conventional phases of tasks in keeping money frameworks, and this thus will without a doubt prompt an unavoidable development of correspondence around the world. All things considered, these issues are available in any state. Against the foundation of taking care of these issues, notwithstanding development, it is likewise anticipated that would set up new principles, which thusly will raise the general level of opening up private organizations, henceforth the economy, since now it will be substantially less demanding, more secure, without mediators and with a lower loan fee.

Distributed Credit Chain is an inventive decentralized environment that plans to diminish, and later on, devastate the credit imposing business model and furthermore enhance existing money related situations. Decentralization will be completed on account of the blockchain innovation, to be specific the group chose to utilize blockchain Ethereum as the premise, concentrating on shrewd contracts.

In the loaning segment of the stage, a Submitting Data Validation (SDV) usage will be made to be effectively inputted into a client’s hazard control framework. The chain information that is gathered alongside the SDV will consequently refresh the endorsement of the request and the application will be put together by the client with their mark that contains the data on true characteristics. The whole lifecycle of a client’s exchanges are spared and dissected with each demand thus it is precisely evaluated, viably making a protected and secure decentralized credit framework for loan specialists and borrowers.

WHY DISTRIBUTED CREDIT CHAIN IS UNIQUE

Cost-viability and Efficient foundation

While it isn’t generally known, in the standard managing an account framework, the awful financial assessment individuals are dialed into the legitimate clients. Hence it doesn’t make a difference on the off chance that you are paying your obligation in time, you will pay a premium to cover the bank’s misfortunes. Also the streamlining of the acquiring forms as paper contracts are exchanged to the disseminated record.

Open Credit History on a Transparent Infrastructure

These days, it is extremely difficult to keep up an all inclusive financial assessment, also that these insights don’t work between banks and you need to experience the whole procedure once more. With the DCC stage, in any case, your total credit scoring and history is put away trustlessly, supported by observational proof. Should you choose to obtain again later on, moneylenders can just inquiry your record from the blockchain.

Self-manageable biological system with compensate instruments

Should any bank locate that any advance application isn’t reasonable for loaning, they will be compensated in DCC tokens for keeping the exclusive expectation of the stage. Banks can set their base DCC edge for them to process the loaning application. Borrowers can expand this breaking point consequently hopping on the need holding up list.

Along these lines, the preparing endeavors are circulated naturally, organizing the people with more supports accessible.

Overall accessible Credit Credentials

Because of decentralized nature of the stage and cross-fringe status, DCC can relate with legitimate tenders of credits in numerous nations. Turning into the stay stage for multinational loaning is one of DCC’s center mantras as loaning in various monetary forms will be accessible.

Respectable Data Warehousing and Data Marketplace

The clients of the DCC stage likewise can offer their made information with respect to credit spending. Money related establishments have an extraordinary requirement for such information as they can build information items and noteworthy experiences that eventually develop their business. Invested individuals can peruse the accessible information on the DCC Data Marketplace and afterward start a blockchain exchange to buy and utilize it further.

CONCLUSION

With my years of experience in the traditional financial world, such development hasn’t been witnessed before. This is an unprecedented landslide move to decentralize the financial world. With the dedicated and experienced team behind this project, it is going to be massive and will stand the test of time.

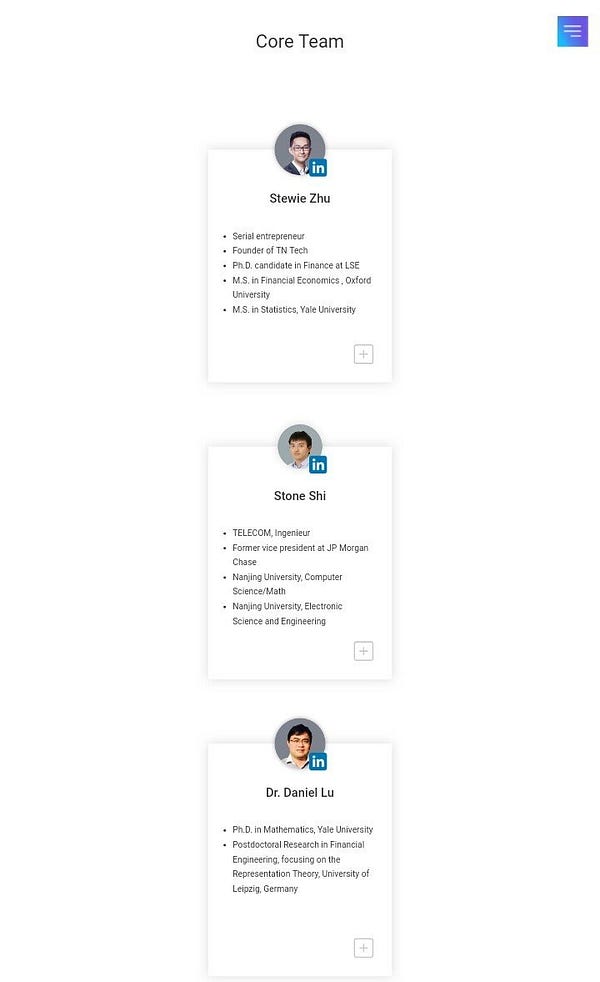

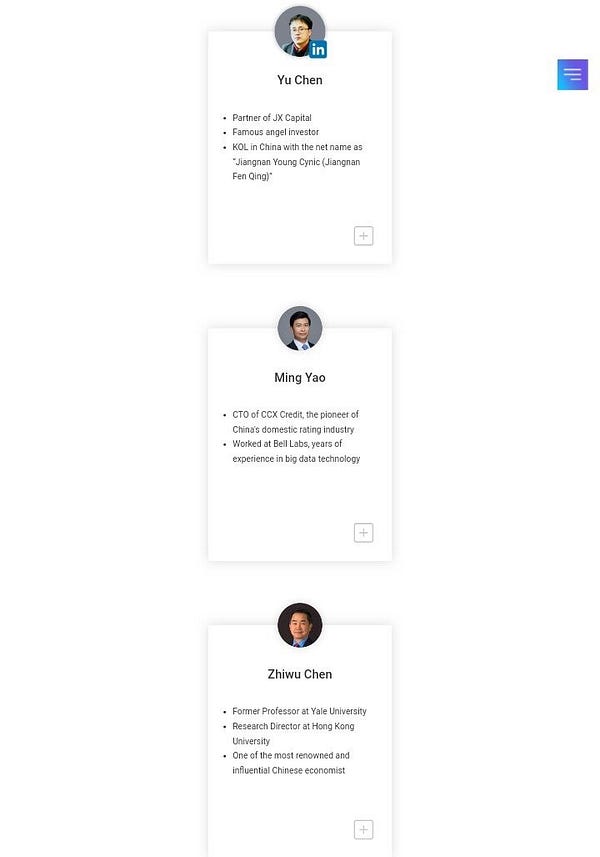

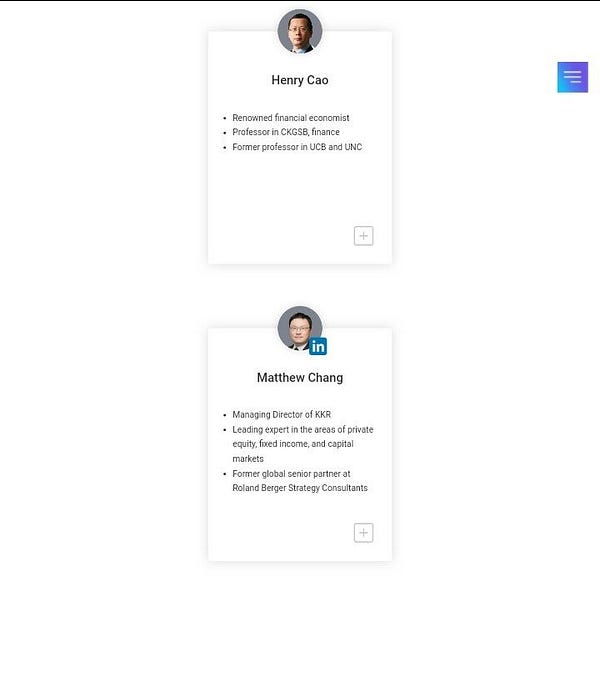

TEAM

ADVISORS

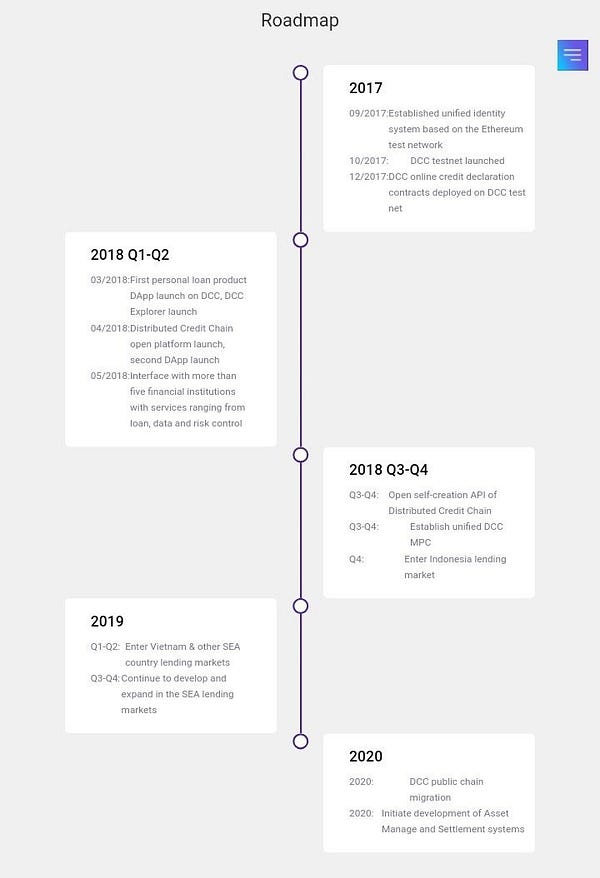

ROADMAP

FOR MORE DETAILS ON DISTRIBUTED CREDIT CHAIN, VISIT THE FOLLOWING LINKS:

WhitePaper: http://dcc.finance/file/DCCwhitepaper.pdf

Website: http://dcc.finance/

Medium Blog: https://medium.com/@dcc.finance2018

Telegram Invite: https://t.me/DccOfficial

— — — — — — — — — — — — — — — — — — —

BitcoinTalk profile link:https://bitcointalk.org/index.php?action=profile;u=1138250;sa=summary

Username: gebitkjteam

Eth : 0xC15Eb4bFf8e038db8Fdf3724129EfFAC3aA010D0

Telegram: @gebibramantyo

Telegram: @gebibramantyo

0 komentar:

Posting Komentar